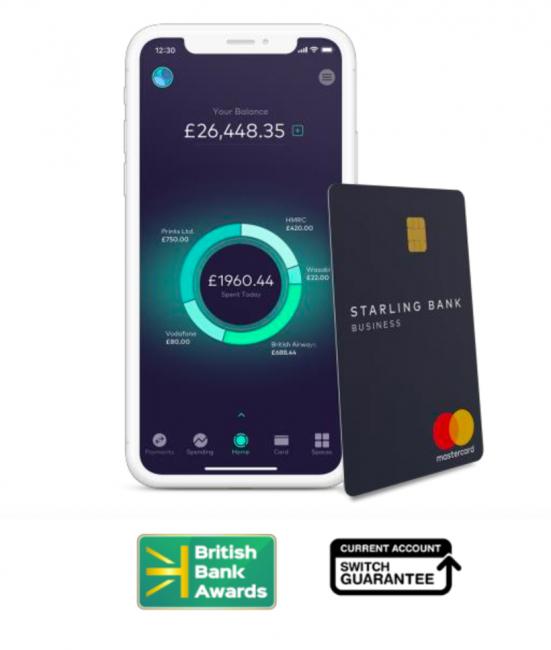

Beautifully simple business banking

Who are Starling Bank?

Founded in 2014 by Anne Boden, Starling is the UK’s first mobile bank offering super-fast setup, beautifully simple money management and 24/7 support, all with no monthly fees. From small businesses with big ambitions to freelancers figuring out tax returns, Starling’s award-winning business bank account is designed to make entrepreneurial life a little easier.

Key features

No monthly account fees

Speedy setup

Apply in minutes, with no three week waits.

Integrated with Quickbooks, Xero and FreeAgent

24/7 UK customer support

Stay in the know

With real time payment alerts and categorised transactions

Easy deposits

Deposit money at over 11,500 Post Office branches* . Send cheques via freepost, too.

FSCS protection

We’re a fully registered bank and the FSCS protects any money you keep with us up to £85,000 for eligible customers.**

* Deposits of up to £1000: £3. Deposits of £1000 and above: 0.3% of the amount deposited. If you withdraw cash using the Post Office Counter Service, we will charge you £0.50 per withdrawal.

** The small business threshold for FSCS is an annual turnover of less than £1m. FSCS does not apply to all business types, please check the FSCS website for eligibility.

,

,